Kelly Criterion Formula

- Kelly Criterion Formula For Excel

- Kelly Criterion Formula Investing

- Kelly Criterion Formula For Excel

- Kelly Criterion Formula For Horse Racing

On this page you'll find a Kelly Criterion Bet Calculator. Enter your assumptions on

Mar 27, 2015 Kelly’s criterion is a good start, but it’s not the full picture. If you visualize the relationship between balance growth and the% of risk, it will look like this: From here we can witness the same pattern as we noticed before – to the left of one Kelly return increases as you increase risk. Apr 09, 2019 The Kelly Criterion is a formula which accepts known probabilities and payoffs as inputs and outputs the proportion of total wealth to bet in order to achieve the maximum growth rate. Kelly Criterion.

- Probability of winning

- Odds and payouts

- Your current bankroll

- Any adjustments you want to make to be conservative

- Mar 26, 2020 The Kelly Criterion is a mathematical formula that helps investors and gamblers calculate what percentage of their money they should allocate to each investment or bet. The Kelly Criterion was.

- Apr 09, 2019 The Kelly Criterion is a formula which accepts known probabilities and payoffs as inputs and outputs the proportion of total wealth to bet in order to achieve the maximum growth rate.

We automatically calculate your ideal bet size with the Kelly Criterion and your assumptions.

The Kelly Criterion Bet Calculator

Practical Application of the Kelly Criterion To Betting Strategies

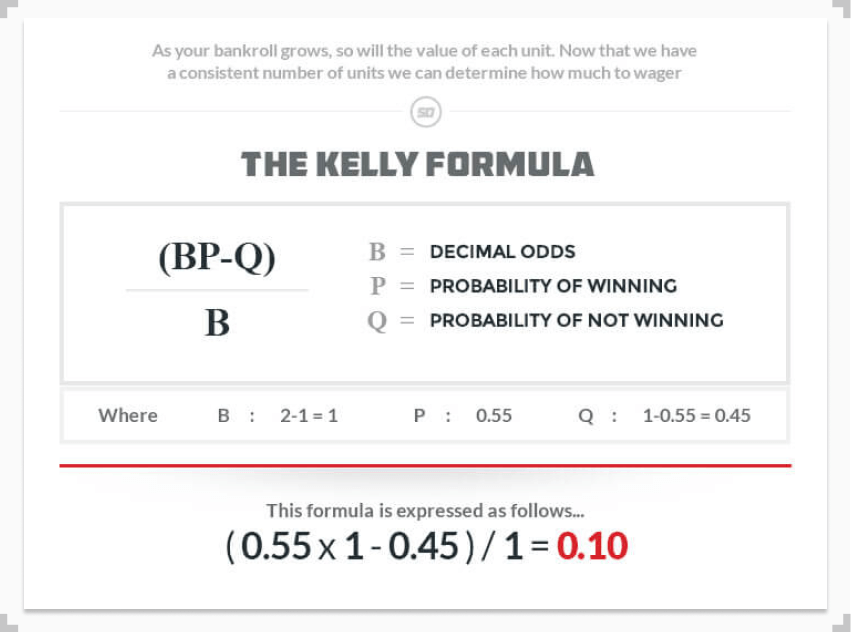

The Kelly Criterion is a formula to determine the proper size of a bet with known odds and a definite payout. With hand waving and basic math you can also use it to help guide your investment decisions.

It's most useful to determine the size of a position you should take.

Using the Kelly Calculator

The Kelly Criterion bet calculator above comes pre-filled with the simplest example: a game of coin flipping stacked in your favor.

- The casino is willing to pay 2 to 1 on any bet you make.

- Your odds of winning any one flip are 50/50.

- Therefore, your probability is .5... 50%.

- Your 'odds offered' are '2 to 1' (so enter 2).

- You have $1,000 with you.

Hit calculate, and see that you should definitely take the bet. Your optimal bet size is 25% of your bankroll.

(Now, find a casino stupid enough to offer those odds!)

Kelly Criterion Formula For Excel

Of course, you can see practical the practical value of Kelly betting when it comes to things with discrete results and obvious probabilities - say pot odds in a poker hand. Your mileage may vary.

What do you think about simple Kelly betting? Even though it is designed to never let you go bankrupt, Kelly still allows wild volatility swings.

Do you prefer another strategy? Perhaps half or quarter Kelly methods?

Kelly Criterion Formula Investing

The Kelly Criterion is a scientific gambling method using a formula for bet sizing that mathematically calculates the proper position size for placing a bet based on the odds. The Kelly bet size is calculated by optimizing the projected value of the wealth logarithm, which is equivalent to maximizing the expected geometric growth rate of the capital being wagered. The Kelly Criterion is a formula used to bet a preset fraction of an account. It can seem counterintuitive in real time.

The Kelly formula is : Kelly % = W – (1-W)/R where:

- Kelly % = percentage of capital to be put into a single trade.

- W = Historical winning percentage of a trading system.

- R = Historical Average Win/Loss ratio.

Kelly Criterion Formula For Excel

Here are the statistics traders need to calculate the Kelly Criterion:

- You can use the data from your trading records or backtesting data for your system for calculating the Kelly Criterion.

- Your system’s winning probability is your “W”.

- Your system’s win/loss ratio is your “R”.

- These numbers are the input into Kelly’s equation above for calculating bet size.

- The Kelly percentage is what the equation returns.

Kelly Criterion Formula For Horse Racing

For an even money bet, the Kelly criterion computes the wager size percentage by multiplying the percent chance to win by two, then subtracting one. So, for a bet with a 70% chance to win (or 0.7 probability), doubling 0.7 equates 1.4, from which you subtract 1, leaving 0.4 as your optimal wager size: 40% of available funds. – Wikipedia